40+ How much could i borrow first time buyer

Take the First Step Towards Your Dream Home See If You Qualify. Top-Rated Mortgage Companies for First-Time Buyers.

What Is Home Equity Wowa Ca

Check home loan eligibility get a quote in minutes.

. Four components make up the mortgage payment which are. With the Help to Buy scheme you can access a government-backed interest-free equity loan that can boost a 5 deposit to 25 in London your 5 deposit can be boosted by. For example a deposit of 20000 is worth 10 of a 200000 house so you.

Specialized mortgage lenders available nationwide. Your deposit can be as low as 5 for first-time home buyers or as high as 40 for buy-to-let mortgages. It represents how much you need to borrow for a property after youve chipped in your deposit.

The quick answer is around 4 to 55 times your income. Apply Online Get The Lowest Rates. A general rule is that these items should not exceed 28 of the borrowers gross.

In the past mortgage lenders were willing to offer 100 mortgages to first-time buyers but since the economic crisis lenders have tightened up and this risky practice was one of the first. Your monthly recurring debt. See How Much You Can Save.

Fast and free to get your personalized rates. Compare Now Save. They will take up 40 or 50.

Get Top-Rated Mortgage Grants. Mortgages are secured loans meaning that you put up the value of your home. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

If you dont know how much your. While this saving of. First time buyers can take out a mortgage of up to 90 of the purchase price of a home.

Compare Standout Lenders For First-Time Home Buyers. Calculate how much you could borrow with our mortgage borrowing calculator. Use your salary and your partners to find out how much you could borrow.

Use our mortgage calculator to work out how much you can borrow in the UK as a first time buyer house mover or if youre looking to remortgage. Your other financial commitments loans credit cards. 455 31 votes So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan.

Get a Home Loan Grant to Buy a Home. The amount you can borrow will depend on the following considerations. That means for a first-time home buyer.

Ad NerdWallet Can Help. Ad Top-Rated Mortgage Lenders 2022. Several factors help the.

Check Your Eligibility for a Low Down Payment FHA Loan. Top Rated Mortgage Advice. However as with all things in life its not quite that simple.

Compare Lowest Mortgage Lender Rates Today in 2022. When arranging mortgages we need to. See if you prequalify for personal loan rates with multiple lenders.

Interest principal insurance and taxes. Moneyfacts says that on a 200000 mortgage at a rate of 25 a borrower would pay around 897 a month on a 25-year term or 660 on a 40-year term. According to market research the average loan amount for first-time buyers is 176693.

How much can I borrow calculator. The amount you have savedacquired as a mortgage deposit. The absolute maximum you can borrow under Central bank limits is 45 times your annual gross household income however lenders are only allowed to go this high on 20 of.

For this reason our calculator uses your. How much can I borrow as a first-time buyer. Find out how much you could borrow.

Ad Compare Lowest Mortgage Lender Rates for First Time Buyers. Contact a loan specialist. Get Instantly Matched with Your Ideal First Time Home Buyer Mortgage.

How much can I borrow as a first-time buyer. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. Ad Loans from 600 to 100000.

Second time buyers can take out a mortgage of up to 80. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. When you are ready to take the next step on your home.

Ad Compare The Best First Time Home Buyer Mortgages. Your ability to borrow money will be determined by. Find A Great Lender For Your Needs And Get One Step Closer To Moving Into Your Next Home.

Ad First Time Home Buyers. Your annual income before taxes The mortgage term youll be seeking. The interest rate youre likely to earn.

Ad Dont wait to take your first step.

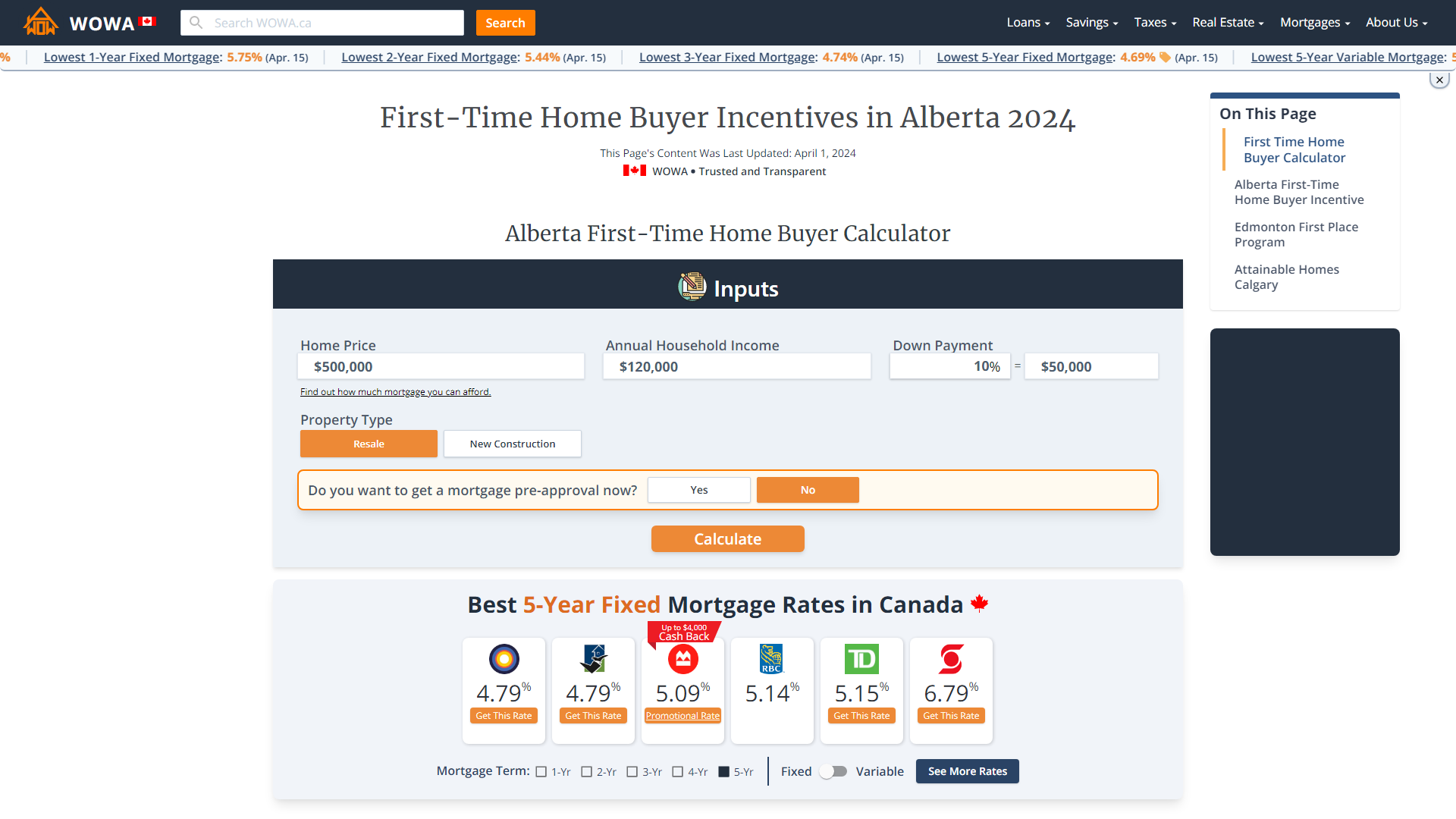

What Is First Home Savings Account Fhsa Wowa Ca

40 Real Estate Marketing Ideas And Strategies To Use Them Curaytor

The Press 03 18 2022 By Brentwood Press Publishing Issuu

Liberal S First Home Savings Account Still A Go R Personalfinancecanada

100 Financing

How To Save Money For A House House Down Payment Saving Money House Budgeting

40 First Apartment Checklist Never Miss Out Things For Your New Life First Apartment Checklist Apartment Checklist Cleaning Checklist

Mortgage Interest Calculator Principal And Interest Wowa Ca

100 Financing

Can I Afford My First House Making 18 50 An Hour I M Not Talking About An Extremely Big Home But More Like A Starter Home Quora

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Fomc Realtor Com Economic Research

How Much Does An Apartment Cost In Osaka May 2022 Update Blog

Enecf Jkzqukym

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

Average Sales Price Of A New Apartment In Japan Hits All Time High 2021 Japan Year In Review Blog

First Time Mom Dad 10 Super Cute Valentines Day Crafts And Treats To Make With Kiddos Of All Ages Fathers Day Crafts Valentine Crafts Valentine Day Crafts